Inside Michael Jackson – Colony Capital Neverland deal: What we learned over time

For a long time Neverland Ranch related topics have been creating a lot of interest and discussion among the fans. With the recent news of Neverland is up for sale for $100 Million, I wanted to do an overview of what we learned over time.

In 2008 first came the Neverland foreclosure news, followed by the news of MJ- Colony Capital Neverland deal. At that time it was widely reported that this was a joint venture between MJ and Colony Capital – meaning both MJ and Colony Capital were part owners ( AP Link, TMZ Link).

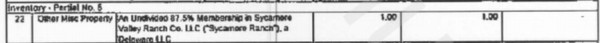

After MJ’s death, we were able to see MJ Estate’s accounting filed in probate court. All three accounting documents to date listed that Estate has 87.5% undivided interest in Neverland.

So to recap, we knew MJ (and later MJ Estate) was in a joint venture with Colony Capital, they were co-owners and had 87.5% interest in Neverland.

Based on the available information, especially due to joint venture and 87.5% interest, fans assumed this meant MJ (and later MJ Estate) had equal decision power as Colony Capital.

In July 2014, MJ Estate sent out a statement to fans alerting them Colony Capital would be selling Neverland soon. In this statement Estate referred to Colony Capital as “property manager” and stated Colony has the “right to sell Neverland” under the MJ-Colony Capital Neverland deal. This created heated discussions as it went against the common belief about Neverland situation. At that time we still did not know the specifics of MJ – Colony Capital Neverland deal.